Diagnosis

A shopping centre diagnosis is a cross-functional assessment based on both consumer and desk research to investigate possible areas of improvements in order to increase traffic, sales and rental income. The analysis covers four main areas: marketing, leasing, management and design.

Acquisition

An acquisition study concerns the assessment of a retail asset’s occupancy cost under two perspectives:

- sustainability

- rental income growth potential

Occupancy costs are defined as sustainable if they represent a reasonable share of the total sales declared by tenants. The ratio of occupancy costs over sales is called effort rate.

UrbiStat owns an extensive database of tenants’ performance in different EMEA regions, across different merchandising categories and retail formats that serves as benchmark for the assessment.

UrbiStat developed considerable know-how in tenants’ performance that enables the basis for the occupancy cost sustainability check and unleashed growth potential analysis of the rental income.

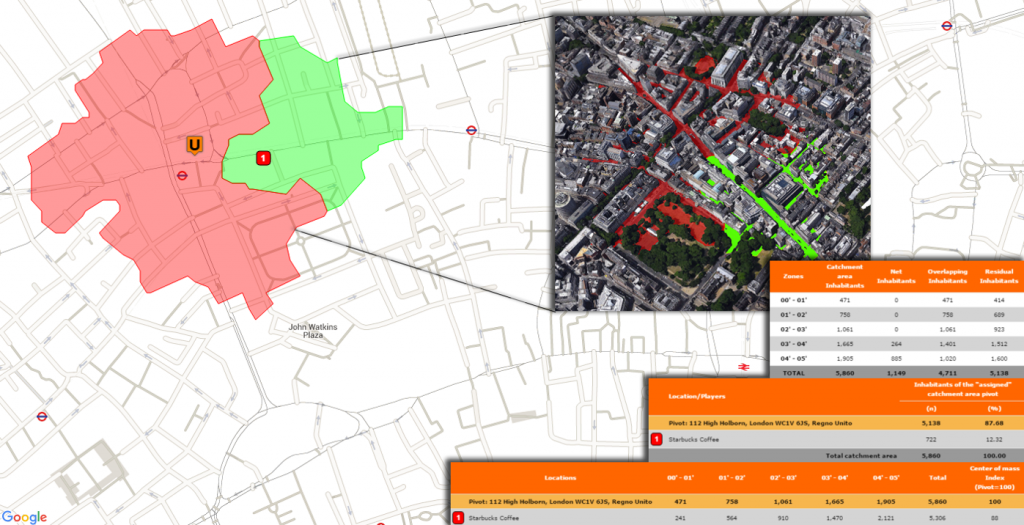

The study is correlated by a deep location analysis, an analytical catchment area definition and the socio economic characterization of residents to elaborate a comprehensive SWOT analysis.

Potential market over consumption

Retail sales retention

Occupancy costs

Rental Income

Impact

This type of study concerns the analysis of new competition opening in a retail asset catchment area. It provides an assessment of the potentially negative impact on annual traffic and related tenants sales. The objective of the study is to verify whether effort rates and the related rental income are still sustainable after the opening of the new competitor to determine if discounts (contractual or extra-contractual) need to be budgeted.

The impact on the annual traffic is assessed through the implementation of an ad-hoc gravity model adjusted to the local catchment area dynamics in terms of visits frequency. The impact on tenants’ sales is assessed through a statistical model developed by UrbiStat and that considers the relationship between different variables like size, distance and sales per visit.

The impact study is correlated by the definition of the current and future geographical catchment area providing insights on marketing campaign and target audience.

Expansion

An expansion study evaluates the impact of additional GLA on the performance of a retail asset under three perspectives: 1) tenants sales; 2) asset rental income; 3) competitive advantage.

Tenants sales are the result of annual visits multiplied by average sales per visit. An expansion can generate more annual visits, higher sales per visit or a combination of both resulting in more sales potential for tenants. The impact on annual visits is estimated through the implementation of a gravity model ad-hoc for the asset under analysis to verify how many more visits can be generated with the additional GLA. The average sales per visit is estimated through a statistical model developed by UrbiStat and that correlates the output with the available non-food critical mass. More GLA equals to higher sales per visit. The overall additional sales potential determines the amount of additional GLA that can be added without jeopardizing the current retailers’ performance.

The expanded asset rental income can increase in volume yet decrease in productivity (per sqm) depending on the merchandising plan, on the estimated sales and accepted effort rates of the expansion. The estimated rental income derived from the expansion study is a fundamental variable to investigate the financial viability of the expansion project.

Finally, an expansion study also investigates the opportunity to create new competitive advantages against the other existing players. In that case, the objective of the expansion is beyond the economics and is eventually part of a defensive/reactive strategy.

Food & Beverage

An important macro sociological trend occurring in most of the EMEA regions is the increasing time and income spent on dining out/eating out activities. Malls are becoming more and more a social destination where shopping is a complementary leisure activities like dining out/eating out. Consumer taste is increasing in quality and malls must adapt their offer integrating the typical fast-food offer with more variety. Therefore, it is becoming a trend to create, refurbish and expand food-court areas.

UrbiStat developed a statistical model to identify the ideal size of gastronomy offer that malls should cater to their visitors. The statistical model takes into account data related to “performing” food-court areas in over 100 shopping centres of the EMEA region. The ideal offer clearly correlates to the annual visits generated by the mall as shown by statistical evidence. The gastronomy sales potential and related sales per visit is investigated by sub category enabling a deep analysis into the food-court ideal mix.

Additionally, UrbiStat, in collaboration with Urbistat International, developed specific and ad-hoc consumer surveys to identify local dynamics in certain catchment areas. The objective is to study the F&B offer under different perspectives: tenants’ side (sales potential), landlord side (rental income) and consumer side (trends, taste, preferences, ideal brands).

Do you need more details?

Get in touch with us, we will send you sample materials and you will be assist by telephone.